december child tax credit payment amount

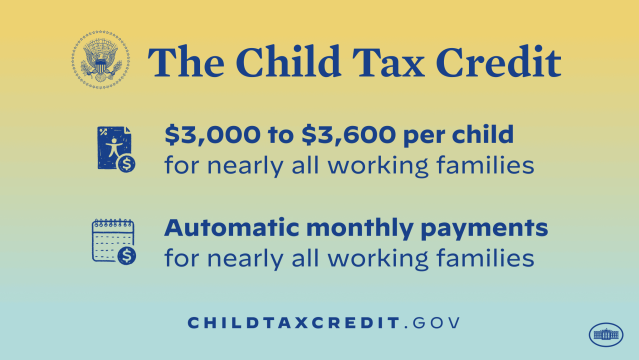

The child tax credits are worth 3600 per child under six in 2021 3000 per child aged between six and 17 and 500 for college students aged up to 24. The deadline to do so is 15 November so those who get their submissions in before Monday could receive a lump sum worth up to 1800 per child in December covering all the missed payments.

The Child Tax Credit Toolkit The White House

And unless Congress decides to extend the monthly payments the final installment will come in December.

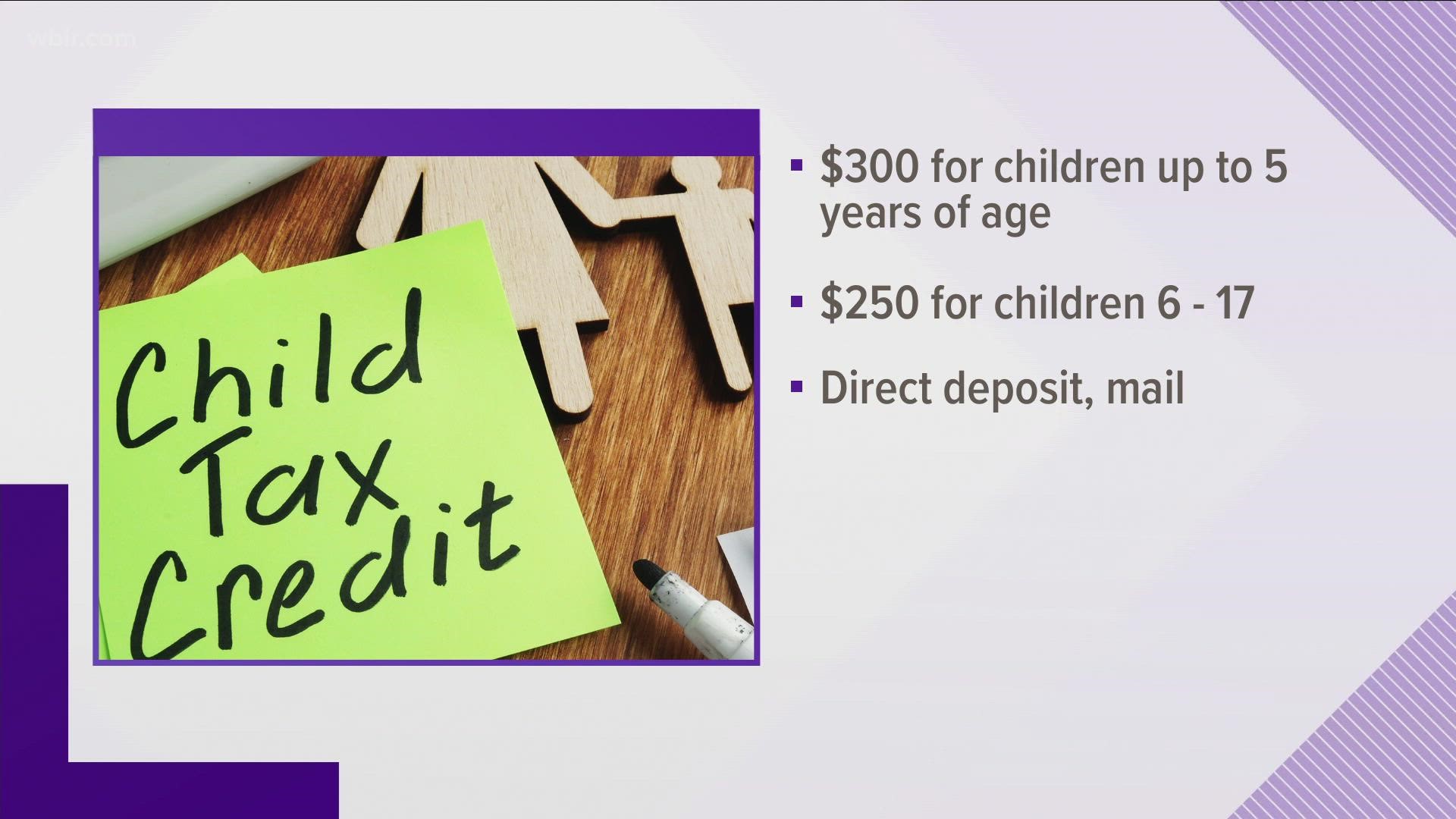

. This amount was then divided into monthly advance payments. Typically the child tax credit provides up to 300 per month for each child under age 6. THE last child tax credit payment is set to go out to millions of families â and how much you get could depend on multiple factorsÂ.

Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. The credit was made fully refundable. Other reasons you may end up paying the payments back is due to divorce a change in custody or a child aging out.

The other half. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to. Child Tax Credit 2022 Monthly Payment Dates.

IRS Child Tax Credit Money. Children draw on top of a Treasury check prop during a rally in front of the US. For parents with children 6-17 the payment for December will be 250.

While the monthly advance payments ended in december the 2022 tax season will deliver the rest of the child tax credit money to eligible parents with their 2021 tax refunds. Eligible parents get 300 for each child who is aged under six and 250 for each child aged between 6 and 17 years old. Eligible families who did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return filed in 2022.

Children under age 6 were given 300 per month and children ages 6-17 were given 250 per month. However if you still havent received any checks or if youre missing money from one of the months. When you file your taxes for 2021 in 2022 you will receive the other half of the benefit.

An eligible individuals total advance Child Tax Credit payment amounts equaled half of the amount of the individuals estimated 2021 Child Tax Credit. For many families the credit then plateaus at 2000 per child and starts to phase out for single parents earning more than 200000. The child tax credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17.

These payments were given starting in July every month with the final one this month on Dec. However theyre automatically issued as monthly advance payments between July and December -. This means that the total advance payment amount will be made in one December payment.

The IRS and US. The amount parents receive depends on the age of the child. For parents with children aged 5 and younger the Child Tax Credit for December will be 300 for each child.

Reporting income changes using the Child Tax Credit Update Portal can help people make sure they get the correct amount of advance child tax credit payments during 2021 especially people who want. Millions of families set to receive the final payment of the year. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500 for college students aged up to 24.

However theyre automatically issued as monthly advance payments between July and December - worth up to 300 per child. December child tax credit payment amount. The last round of monthly child tax credit payments will arrive in bank accounts on dec.

Child Tax Credit December. THE final advance child tax credit payment will be deposited today into the account of millions of Americans. The monthly child tax credit payments have come to an end but more money is coming next year.

Families with children between 6 to 17 can claim the full amount of 3000 per child if they didnt get any monthly payments. This means a payment of up to 1800 for each child under 6 and up to 1500 for each child age 6 to 17. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18.

What happens to the CTC after December. This includes families who. The final payment for the child tax credit will be made on 15 december.

How to still get 1800 per kid before 2022. The monthly check has been a welcome relief for families trying to get back on their feet but some are surprised by the amount. Claim the full Child Tax Credit on the 2021 tax return.

The December child tax credit payment may be the last. For each qualifying child age 5 or younger an eligible individual generally received 300 each month. The child tax credit worth up to 3600 for each kid has gone out in monthly installments since July.

Most parents who received monthly payments in 2021 will have more child tax credit money coming this year. Dont Miss an Extra 1800 per Kid. The next child tax credit check goes out Monday November 15.

What To Know About The Child Tax Credit The New York Times

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com

Child Tax Credit United States Wikipedia

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

December Child Tax Credit Why Some Parents Were Only Paid Half And What To Do If You Didn T Get It At All

Last Child Tax Credit Payment Amount Explained How Much Will You Get This Week

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Stimulus Update Could 300 Monthly Federal Child Tax Credit Be Made Permanent Cleveland Com

2021 Child Tax Credit Advanced Payment Option Tas

The Expanded Child Tax Credit Briefly Slashed Child Poverty Here S What Else It Did In 2022 Child Tax Credit Poverty Children Tax Credits

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit January 2022 When Could Ctc Payments Start In 2022 Marca

Child Tax Credit Schedule 8812 H R Block

The Last Monthly Child Tax Credit Payments Go Out On Dec 15 The Washington Post

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities